View:

April 30, 2024

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

April 30, 2024 12:10 PM UTC

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.

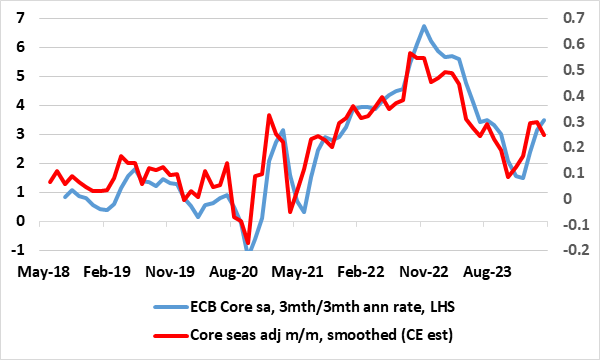

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex

April 29, 2024

Preview: Due May 14 - U.S. April PPI - New Year strength fading

April 29, 2024 6:08 PM UTC

We expect a 0.3% increase in April’s PPI, with gains of 0.2% in the core rates ex food and energy and ex food, energy and trade. The core rates would match March’s outcome which slowed from above trend gains in January and February.

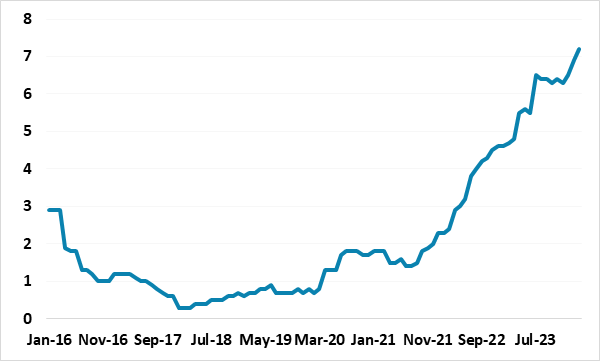

UK Consumers: Rent the Growing Hit to Spending Power

April 29, 2024 2:02 PM UTC

The UK has faced a series of cost-of-living shocks in the last few years. Some such as the surge in food prices may even be reversing, while it now looks likely the BoE hiking cycle may also start to reverse, although rising market rates may mean little further fall in effective mortgage rates in

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

Preview: Due April 30 - Canada February GDP - Another rise, but a slower one

April 29, 2024 12:20 PM UTC

We expect Canadian GDP to increase by 0.3% in February, slightly below a 0.4% estimate that was made with January’s report, where a strong 0.6% monthly increase was seen, flattered by the end of public sector strikes. We expect preliminary indications for March to be near flat.

Preview: Due April 30 - U.S. Q1 Employment Cost Index - Trend slowing, but still quite firm

April 29, 2024 12:12 PM UTC

We look for the Q1 employment cost index (ECI) to increase by 0.9%, matching the Q4 increase that was the slowest since Q1 2021. Yr/yr growth will continue to slow, to 3.9% from 4.2%, reaching its slowest since Q3 2021, but will remain well above the pre-pandemic trend.

Indonesia: MPC Review: Bank Indonesia Surprises With A Rate Hike

April 29, 2024 11:26 AM UTC

In a pre-emptive move to both curb inflationary pressures and safeguard the Indonesia Rupiah (IDR) against furhter depreciation, Bank Indonesia, in a surprise move, increased its main policy rate by 25 bps to 6.25%. However, further rate hikes are not expected as the central bank remains wary of hur