View:

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

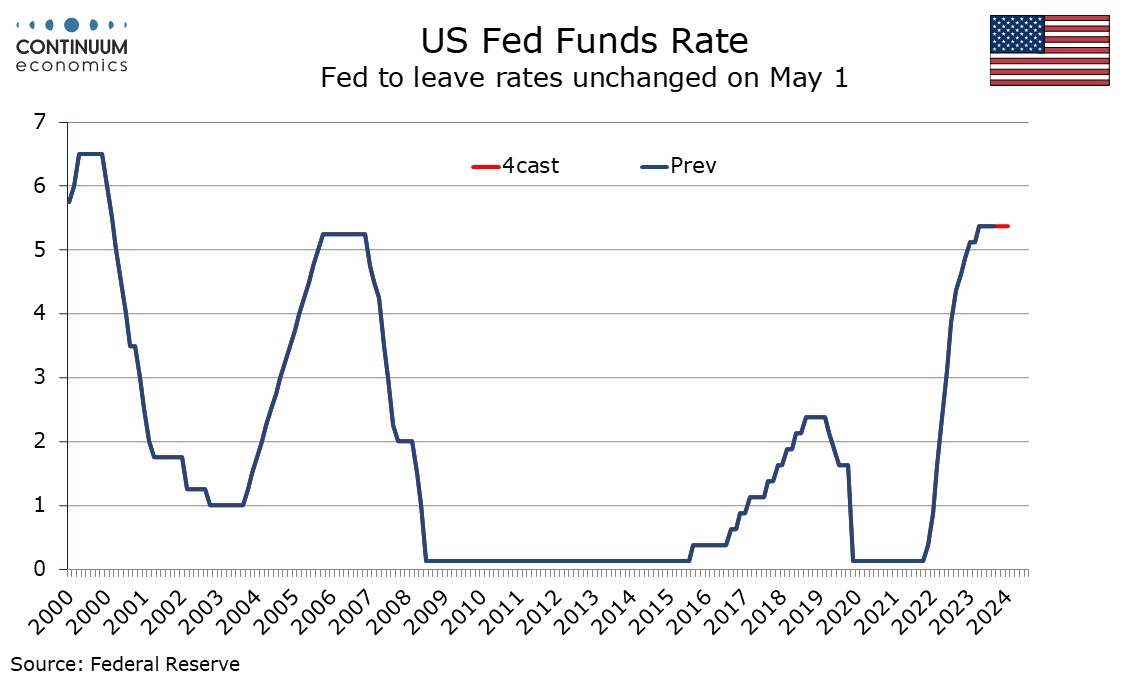

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

Bank of Canada Minutes Look to Gradual Easing, Divided on When to Start

April 24, 2024 6:44 PM UTC

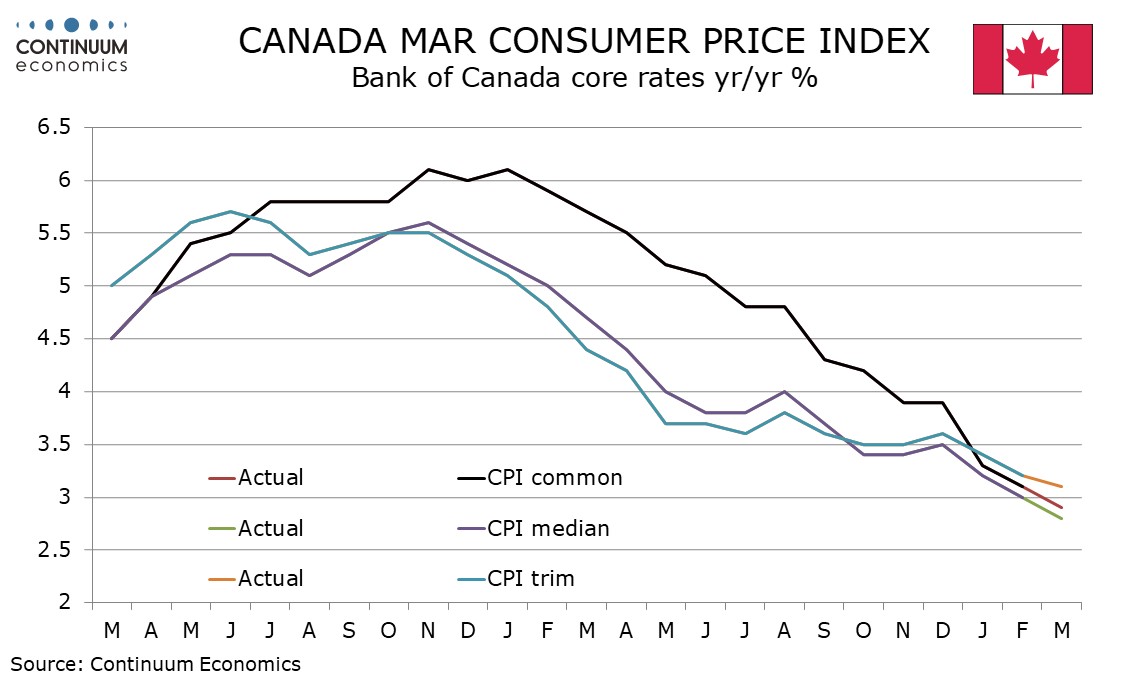

Bank of Canada minutes from the April 10 meeting confirm a greater confidence on inflation falling, though there is disagreement within the Governing Council over when policy easing will become appropriate. There was agreement that easing would probably be gradual given the risks to the outlook and

U.S. March Retail Sales allow Q1 to come in marginally positive despite a weak start in January

April 15, 2024 12:56 PM UTC

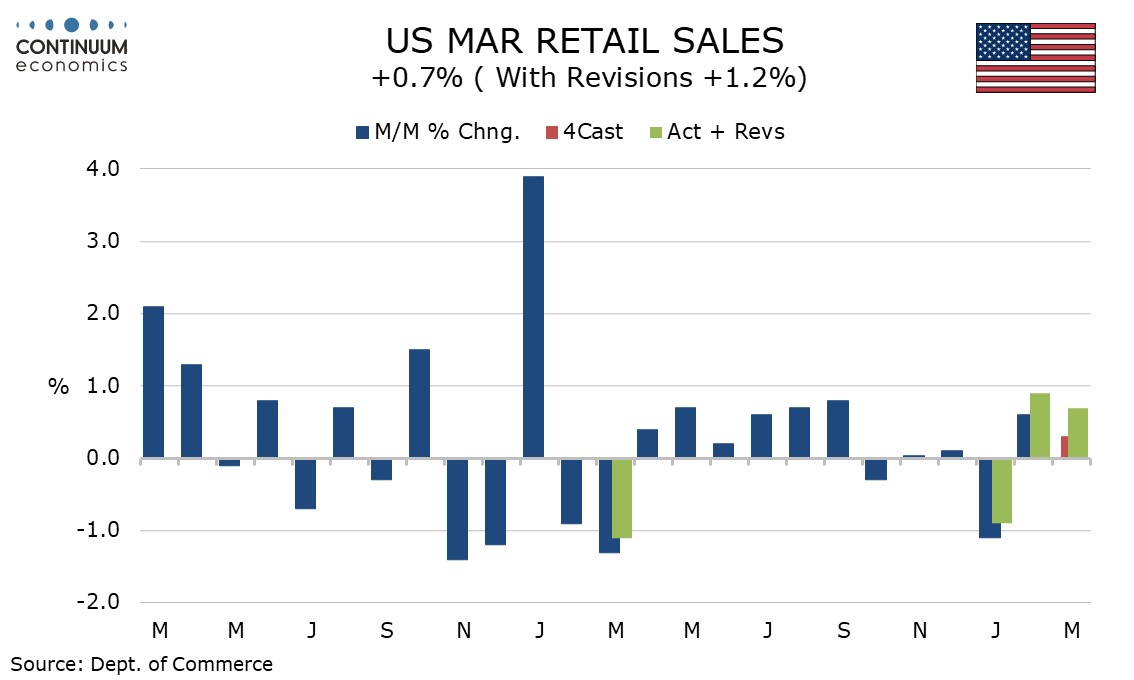

March retail sales with a 0.7% increase have exceeded expectations despite an expected negative contribution from autos, with sales up by 1.1% both ex autos and in the control group that contributes to GDP, and by 1.0% ex autos and gasoline. This suggest continued consumer momentum entering Q2.

Banxico Minutes: Hawkish Cut and Different Views

April 5, 2024 2:18 PM UTC

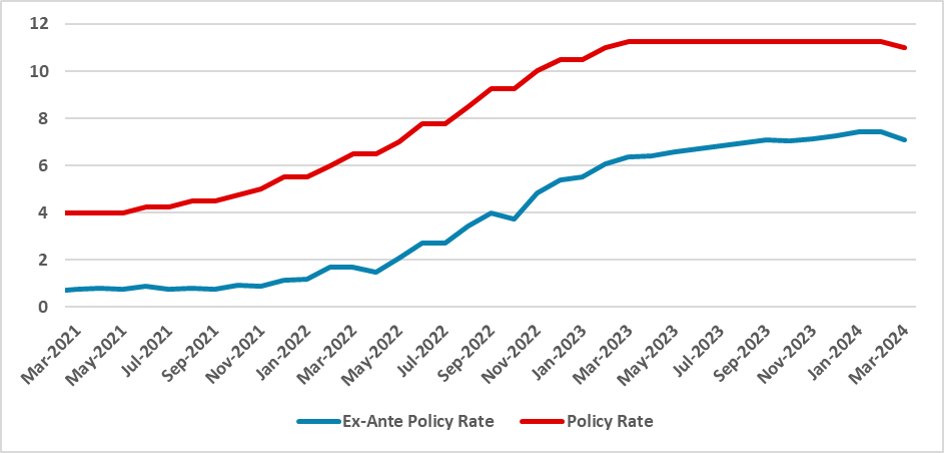

Banxico's recent meeting minutes reveal a split among board members regarding monetary policy, with a 25bps rate cut to 11.0%. Despite progress in curbing inflation, differing views on policy direction persist. Inflation expectations deviate from targets, with potential risks in fiscal policy and wa

Canada March Employment - A weak month after two solid ones

April 5, 2024 1:35 PM UTC

Canada’s 2.2k decline in March employment is weaker than expected though needs to be seen alongside strong gains of 40.7k in February and 37.7k in January. The 3-month average of 25k is above the 6-month average of 22k. However with the labor force rising unemployment is trending higher, March’s

Asset Allocation: Pausing for Breath

April 2, 2024 9:00 AM UTC

Into Q2, data and policy (actual and perceived) will dominate DM markets. The ECB will likely take the spotlight with a 25bps cut on June 7, as the Fed face a better growth/more fiscal policy expansion and a tighter labor market than the EZ but also with a better productivity backdrop and outlook to

Preview: Due April 16 - Canada March CPI - Correction after two soft months

April 15, 2024 1:22 PM UTC

We expect March Canadian CPI to move higher to 3.0% yr/yr from 2.8% in February and 2.9% in January, with the monthly data likely to look quite firm after two soft months. However we do expect some modest progress lower in two of the three BoC’s core rates.

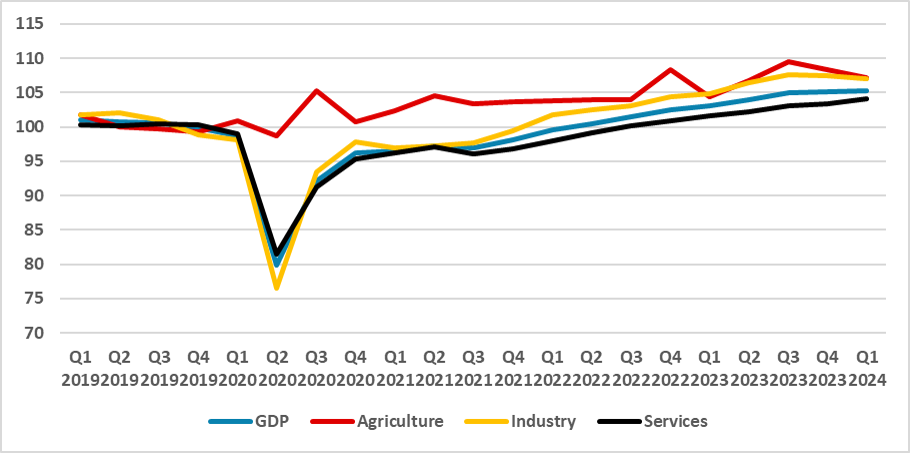

Mexico GDP Review: 0.2% Growth but Still Subpar

April 30, 2024 5:54 PM UTC

INEGI released Mexico's Preliminary GDP for Q1 2024, showing 0.2% growth, slightly above expectations. Annual GDP slowed to 2.0% from 2.8% in Q4 2023. The economy is losing momentum due to tight monetary policy and weakened U.S. demand. Agriculture contracted by 1.1%, Industry by 0.4%, while Service

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

April 30, 2024 5:15 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though inflationary pressures will still look quite significant in A

U.S. April Consumer Confidence - Labor markets seen as less strong

April 30, 2024 2:23 PM UTC

April consumer confidence with a fall to 97.0 from 103.1 is weaker than expected and the lowest since July 2022. The easiest explanation for this is rising bond yields and fading expectations for rate cuts, though there are hints that the labor market is losing momentum too.

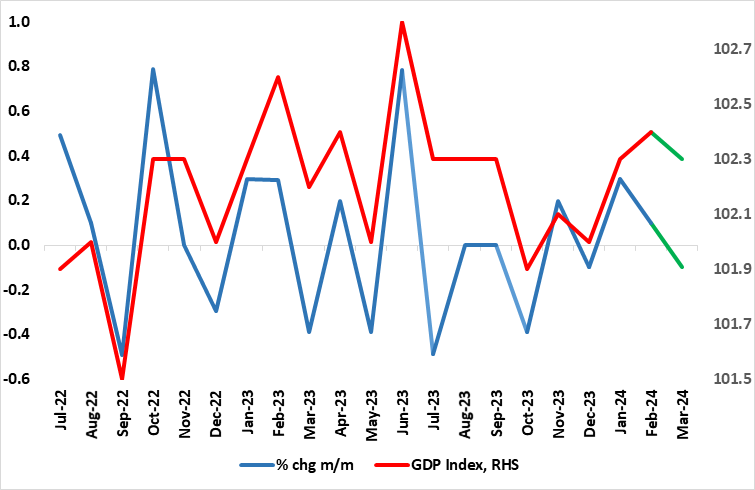

UK GDP Preview (May 10): Fragile Sideways-Moving Activity Continues?

April 30, 2024 2:19 PM UTC

The economy may have been in only mild recession in H2 last year, but the ‘recovery’ now evident is hardly much better with GDP growth only modestly positive. Admittedly, coming in as largely expected, and despite industrial action, GDP rose by 0.1% m/m in February accentuating the upgraded 0.

Canada February GDP - Q1 looking less positive than previously projected

April 30, 2024 1:20 PM UTC

February Canadian GDP saw a second straight rise, but at 0.2% was below the 0.4% projected with January’s data and January was revised down to a 0.5% increase from 0.6%. The advance estimate for March is unchanged, which would leave a 0.6% rise (2.5% annualized) in Q1.

U.S. Q1 Employment Cost Index - Acceleration will add to Fed concerns on inflation

April 30, 2024 12:46 PM UTC

The Q1 Employment Cost Index with a 1.2% increase is stronger than expected and like Q1 inflation data, breaks a trend of gradual slowing seen in late 2023 to produce a renewed acceleration, rising by its most since Q1 2023.

Preview: Due May 1 - U.S. April ADP Employment - Underperforming payrolls

April 30, 2024 12:10 PM UTC

We expect a 150k increase in April’s ADP estimate for private sector employment growth, which would be in line with recent trend, but continuing to underperform private sector non-farm payrolls, which we expect to rise by 195k. We expect overall payrolls to rise by 255k.

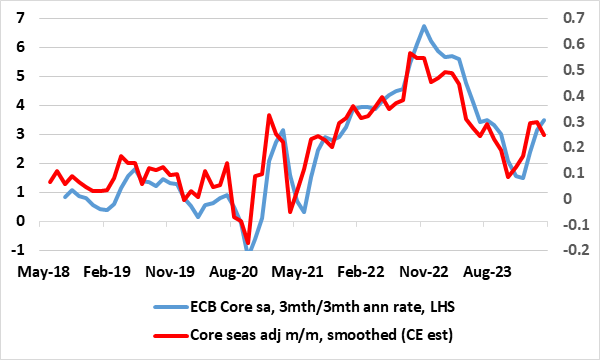

Eurozone Data Review: Less Weak But Soft Domestic Demand Taking Less Toll on Core Inflation?

April 30, 2024 9:29 AM UTC

According to revised official national accounts data, the EZ economy was in recession in H2 last year, albeit modestly so and against a backdrop of marked, if not increasing, national growth divergences. This geographical variation continued into Q1 (Figure 1) where the flash GDP reading exceeded ex